This document provides an overview of utilizing EEI on UPS shipments in DesktopShipper.

What is EEI?

EEI stands for "Electronic Export Information." It is a component of the Automated Export System (AES) used by the U.S. Census Bureau and the U.S. Customs and Border Protection to collect and track data about exports from the United States. EEI includes information about the commodities being exported, the parties involved in the transaction, and other details related to the export process.

*It is required for most international shipments valued over $2,500 or shipments that require an export license.

Note: Complete EEI Information is required for all shipments to China, Russia, and Venezuela.

Why is EEI Beneficial?

-Providing incorrect export information can result in significant penalties and fines. Shippers can avoid these penalties by submitting accurate and complete EEI.

-Properly submitted EII can result in faster customs clearance times.

-It simplifies the documentation process in terms of storing and managing records.

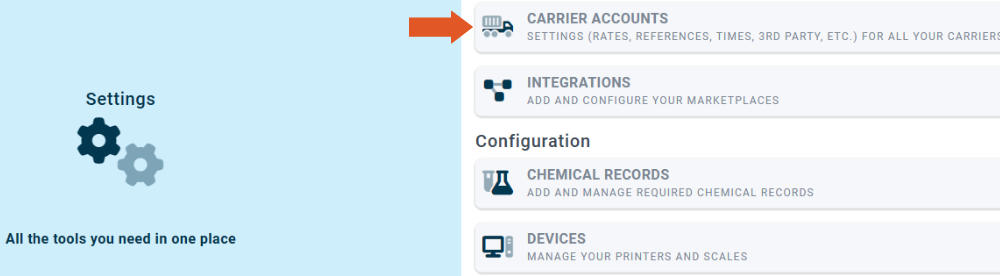

Setting up EEI for a UPS Account

- Navigate to the " Carrier Accounts" settings.

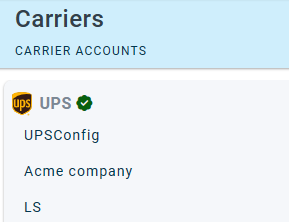

- Select a UPS account from the left-hand side.

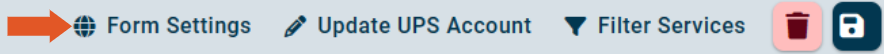

- At the top of the account page, click "Form Settings."

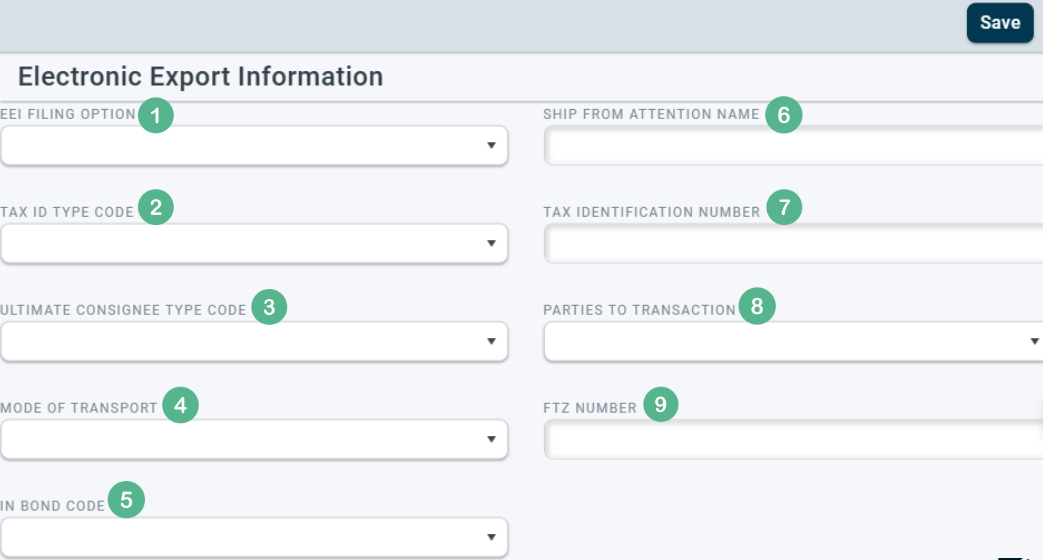

Fill in the fields in the "International Form Settings" window.

1. An "EEI filing option" refers to the various methods available for submitting the Electronic Export Information (EEI) to the U.S. Census Bureau and the U.S. Customs and Border Protection as part of the export process.

AESDirect is the U.S. Census Bureau's free online filing system that allows exporters to submit EEI directly to the government. It's user-friendly and accessible to businesses of all sizes.

2. Select the EIN Tax ID Type Code.

EIN stands for Employer Identification Number. It is a unique nine-digit number the Internal Revenue Service (IRS) assigns.

DNS and FGN pertain to intricately specialized domains used within limited expertise circles.

3. The "consignee type" refers to the type of entity that is the recipient of the exported goods. Options are: Direct Consumer, Government Entity, Reseller, Other/Unknown.

4. The mode or method of transport by which goods are transported from one location to another for export. Example: Rail.

5. The "In Bond Code" describes the customs status of the goods. This code helps customs authorities understand the specific nature of the shipment and its relationship to customs procedures. Different codes can represent various scenarios, such as goods in transit, warehoused goods, etc.. select the appropriate "In Bond Code."

6. The individual or entity's name at the location from which the export shipment originates. This information is part of the details you provide when filing EEI through the U.S. Census Bureau's Automated Export System.

7. A Tax Identification Number (TIN) is a unique identification number used by individuals and entities for tax purposes. It helps tax authorities track and manage tax-related activities, such as income reporting, tax payments, and compliance. If you need to obtain a TIN, it's best to consult the official website of your country's tax authority or contact a tax professional who can guide you through the process and provide accurate information based on the regulations in your jurisdiction.

8. The individuals or entities that are involved in the export transaction. This field typically includes Seller/ Exporter, Buyer/ Importer, Purchaser, etc.

9. FTZ = Foreign Trade Zone. A Foreign Trade Zone (FTZ) is a designated area within a country where goods can be stored, handled, and processed without being subject to customs duties or certain taxes until they are formally entered into the customs territory for consumption. Each FTZ number is unique, and numbers vary greatly depending on the country and regulations. It is recommended to check with the official website of U.S. Customs and Border Protection or other relevant trade and customs authorities to get the most current and accurate information regarding FTZ-related forms and procedures.

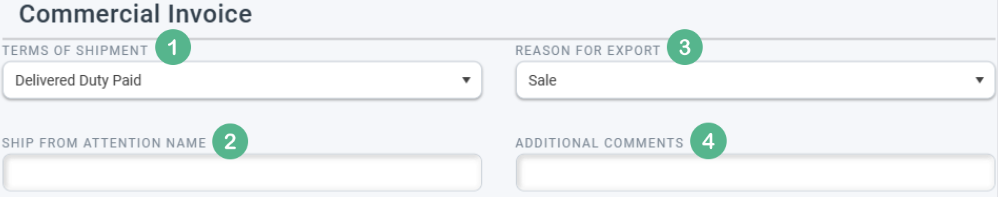

Next, fill in the Commercial Invoice section.

1. The "terms of shipment" on a commercial invoice refer to the agreed-upon conditions that dictate the responsibilities of the parties involved in transporting goods.

2. The name of a person, department, or organization responsible for overseeing the shipment's preparation, documentation, and initial handling before it is handed over to the carrier or shipping company for transport.

3. Select the reason for exporting the goods—options: Sale, Gift, Sample, Return, Repair, Intercompany Data. The most common selection is sale.

4. The "additional comments" section allows the exporter or the person preparing the invoice to provide supplementary information that might not fit within the standard fields of the invoice form but is still essential for the recipient to know. This field is optional.

Remember to save when both sections are complete.

You are now ready to ship international orders using UPS EEI.

-3.png?width=688&height=172&name=DS%20NEW%20Logo%20(LinkedIn%20Banners)-3.png)